Wealth Starter

Advisors

Mathematically driven investment decisions

Recognize trends before they begin

End of year PROMOTION! New members join for only $10 per month!

Take advantage now, cancel at any time.

Let's talk about what we offer.

Investment Insights

Institutional-level investment tracking, but for all types of investors…experienced, or beginner.

Predictive Algorithm

Access to our data-driven model that helps determine potential future performance.

Data-driven analytics covering over 500:

individual stocks

country ETFs

commodities

bonds

cryptocurrencies

and more!

Additional features that boost your investment awareness:

Investment Search

Check out

investments that

you care about.

Current Trends

Explore the

latest snapshot of

where trends are.

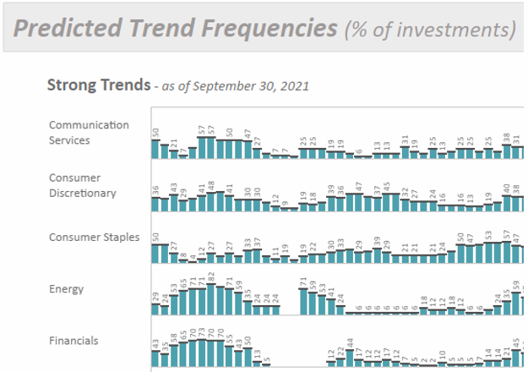

Trend Frequencies

Discover which

asset classes are

currently trending.

Historical Heat Maps

Visualize

macro and sector

trend history.

Our fundamental principles.

Applied Mathematics

An algorithmic and mathematical process can be

established to predict price movement direction of

stocks, exchange-traded funds, and mutual funds.

Research Expectation vs. Reality

Strong fundamental research can produce “correct” results, but investments can still experience unfavorable price movements. Focus rather on price movement analysis.

Emotions Do Not Dictate Process

Invest capital without opinion, feelings, or pre-determined assumptions. Instead, allow mathematics to build a

portfolio of high risk-adjusted return capabilities.

Market Participants Drive Process

The broad market defines early-stage underlying price

movements. This algorithmic investment process

measures and captures these movements.

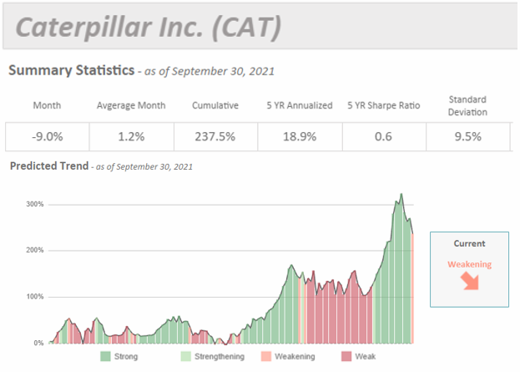

See the algorithm in action!

Join today for access to over 500 different investments

How to interpret the algorithm graph:

Strong or Strengthening

When the underlying investment trend begins to ‘strengthen‘, the algorithm predicts that the future performance will likely be positive. This continues monthly until the investment begins to ‘weaken‘ (orange, red).

Weak or Weakening

As the underlying rate of change trend breaks down, the algorithm predicts that the future performance will likely be negative. This continues monthly until the investment begins to strengthen (green).

Explore investments across entire sectors!

How to interpret the heat map above:

Sectors Trending Upwards

When sectors are trending upwards, our predictive algorithm determines that these have more ‘strengthening‘ investments. Overall, these sectors likely will perform well until they begin to begin curving downwards.

Sectors Trending Downwards

Sectors that are turning, or trending, downwards have more ‘weakening‘ investments as determined by our algorithm. These sectors are not expected to perform well in the future until their direction changes.

Start making better investment decisions!

Important disclosures:

Wealth Starter Advisors LLC does not render personalized investment advice. The content and services found here are provided to you for informational purposes only and should not be construed as an offer to buy or sell a particular security, or investment. Further, content is not a solicitation of offers to buy or sell a particular security, or investment.

All users should consult a financial advisor, tax, or legal professional before making investment decisions. Past performance is not a guarantee of future results. Investing involves risks, including loss of principal.